All Categories

Featured

Table of Contents

The settlements that would certainly have or else gone to a financial organization are repaid to your individual pool that would have been used. The result? Even more cash goes into your system, and each dollar is doing numerous jobs. Recapturing rate of interest and reducing the tax worry is a great story. It gets even better.

This money can be used tax-free. The money you utilize can be paid back at your leisure with no set settlement schedule.

This is exactly how family members pass on systems of riches that enable the following generation to follow their dreams, begin organizations, and make use of possibilities without losing it all to estate and inheritance tax obligations. Companies and banking institutions use this technique to create working pools of capital for their organizations.

Can anyone benefit from Infinite Banking?

Walt Disney utilized this strategy to start his desire for building a style park for youngsters. We 'd enjoy to share more examples. The concern is, what do desire? Peace of mind? Financial safety? An audio financial service that does not count on a rising and fall market? To have cash for emergency situations and chances? To have something to hand down to the people you love? Are you going to find out more? Financial Preparation Has Failed.

Join among our webinars, or go to an IBC bootcamp, all absolutely free. At no cost to you, we will certainly educate you extra concerning how IBC functions, and produce with you a plan that works to address your trouble. There is no commitment at any point in the process.

This is life. This is legacy (Leverage life insurance). Get in touch with one of our IBC Coaches immediately so we can reveal you the power of IBC and whole life insurance policy today. ( 888) 439-0777.

It feels like the name of this concept modifications as soon as a month. You may have heard it referred to as a perpetual riches method, family members banking, or circle of wide range. Regardless of what name it's called, limitless financial is pitched as a secret method to construct wide range that just rich individuals learn about.

What happens if I stop using Private Banking Strategies?

You, the policyholder, put cash right into an entire life insurance coverage plan with paying premiums and buying paid-up additions.

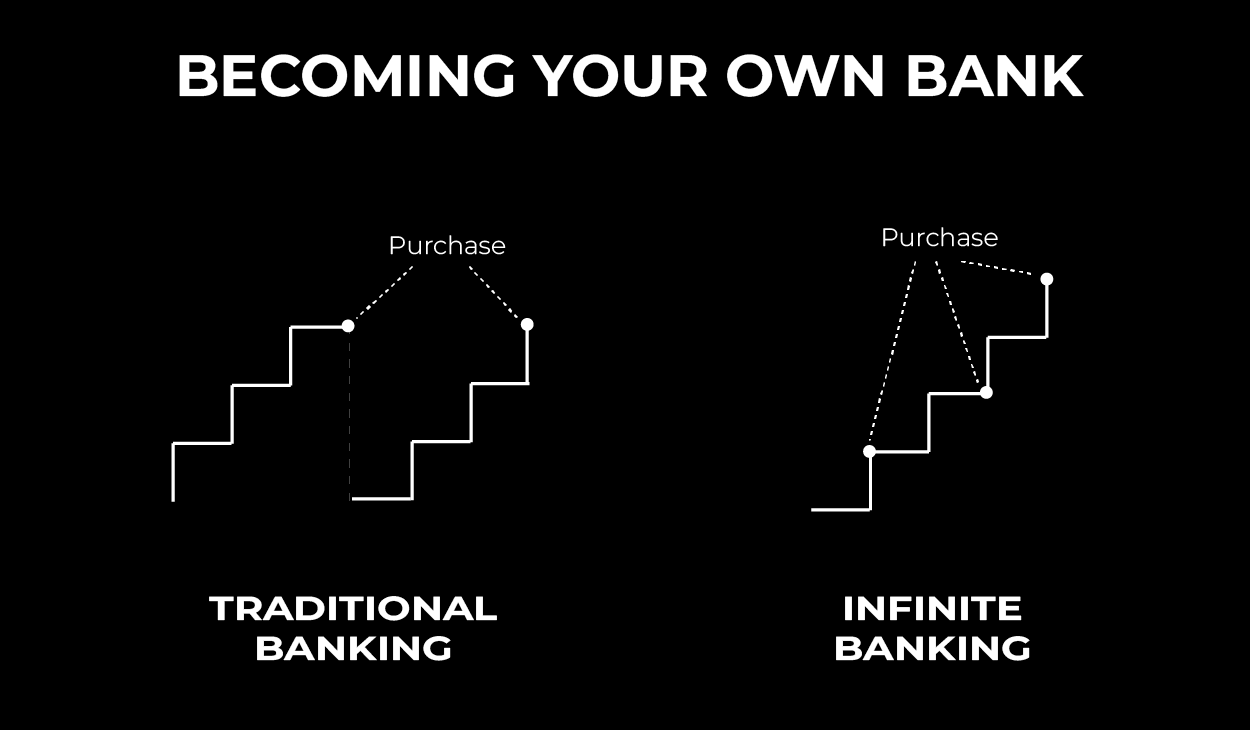

The entire concept of "banking on yourself" only works since you can "financial institution" on yourself by taking car loans from the plan (the arrow in the graph above going from entire life insurance coverage back to the policyholder). There are two various types of finances the insurance coverage business might use, either direct recognition or non-direct acknowledgment.

One attribute called "wash finances" sets the interest price on fundings to the very same rate as the dividend rate. This indicates you can borrow from the plan without paying rate of interest or obtaining interest on the amount you obtain. The draw of infinite financial is a returns passion price and guaranteed minimum rate of return.

The downsides of limitless financial are usually overlooked or otherwise discussed at all (much of the details readily available concerning this principle is from insurance policy representatives, which might be a little prejudiced). Only the cash money value is growing at the dividend price. You also need to pay for the price of insurance, fees, and expenses.

Who can help me set up Borrowing Against Cash Value?

Firms that offer non-direct acknowledgment finances might have a lower returns price. Your cash is locked right into a complex insurance product, and abandonment charges typically do not vanish up until you have actually had the plan for 10 to 15 years. Every long-term life insurance policy plan is various, but it's clear someone's overall return on every dollar spent on an insurance coverage product might not be anywhere close to the reward rate for the policy.

To give a really fundamental and hypothetical example, let's presume a person is able to make 3%, on average, for every dollar they spend on an "boundless financial" insurance item (after all expenses and fees). If we presume those bucks would certainly be subject to 50% in taxes total if not in the insurance item, the tax-adjusted rate of return can be 4.5%.

We presume greater than typical returns on the whole life product and an extremely high tax price on dollars not take into the plan (that makes the insurance coverage product look better). The reality for numerous people may be worse. This pales in comparison to the lasting return of the S&P 500 of over 10%.

Infinite Banking For Financial Freedom

Limitless banking is a terrific product for representatives that offer insurance coverage, however might not be ideal when compared to the cheaper choices (without any sales people making fat commissions). Right here's a break down of some of the other supposed advantages of boundless banking and why they may not be all they're split up to be.

At the end of the day you are getting an insurance policy item. We enjoy the protection that insurance coverage uses, which can be gotten a lot less expensively from a low-cost term life insurance policy policy. Unpaid lendings from the plan may likewise reduce your death benefit, lessening one more degree of security in the policy.

The idea just works when you not just pay the substantial premiums, yet make use of added money to buy paid-up enhancements. The opportunity expense of all of those bucks is significant very so when you can instead be spending in a Roth IRA, HSA, or 401(k). Even when compared to a taxed financial investment account or perhaps an interest-bearing account, limitless financial may not offer comparable returns (compared to investing) and equivalent liquidity, access, and low/no charge framework (contrasted to a high-yield interest-bearing accounts).

As a matter of fact, many individuals have never heard of Infinite Banking. Yet we're right here to alter that. Infinite Banking is a method to manage your cash in which you develop an individual bank that works similar to a routine bank. What does that mean? Well, we said that conventional banks are made use of for storage facilities and funding.

Who can help me set up Self-financing With Life Insurance?

Just placed, you're doing the financial, yet rather of depending on the traditional financial institution, you have your own system and total control.

Infinite Banking isn't called that means without a reasonwe have infinite ways of implementing this procedure into our lives in order to genuinely have our way of living. So, in today's write-up, we'll show you 4 various methods to make use of Infinite Financial in organization. We'll discuss 6 ways you can utilize Infinite Banking personally.

Latest Posts

Non Direct Recognition Whole Life Insurance

Becoming Your Own Banker Explained - Round Table

Using Whole Life Insurance As A Bank