All Categories

Featured

Table of Contents

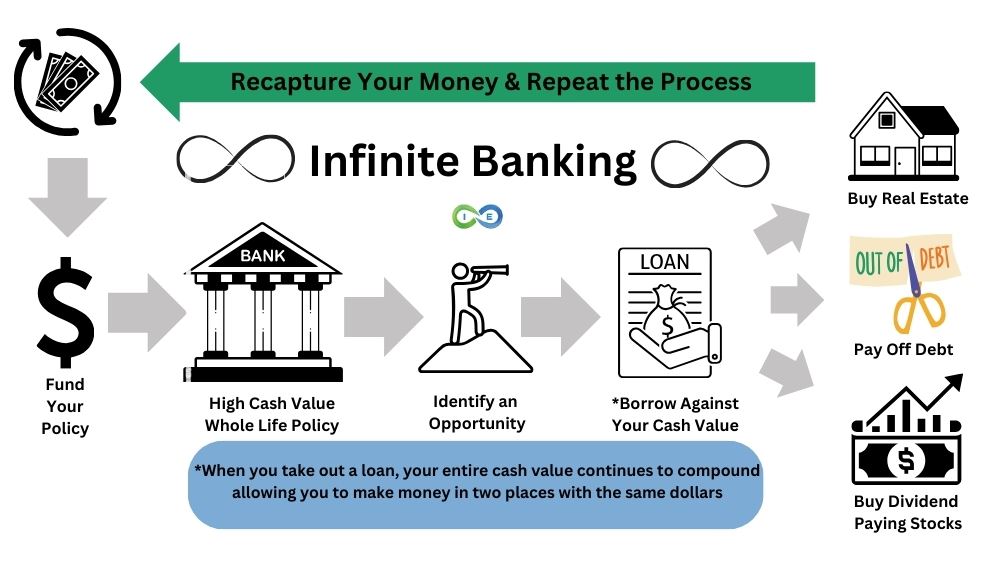

The approach has its own benefits, yet it additionally has issues with high fees, complexity, and extra, resulting in it being considered as a rip-off by some. Unlimited financial is not the most effective plan if you require only the investment element. The infinite banking principle focuses on using whole life insurance policies as a monetary tool.

A PUAR permits you to "overfund" your insurance coverage policy right as much as line of it ending up being a Modified Endowment Agreement (MEC). When you make use of a PUAR, you rapidly boost your cash worth (and your survivor benefit), consequently increasing the power of your "bank". Even more, the even more cash worth you have, the better your rate of interest and reward settlements from your insurer will certainly be.

With the surge of TikTok as an information-sharing system, economic guidance and strategies have located a novel means of dispersing. One such method that has actually been making the rounds is the unlimited banking principle, or IBC for short, garnering endorsements from stars like rapper Waka Flocka Flame - Cash flow banking. Nevertheless, while the technique is presently preferred, its origins map back to the 1980s when financial expert Nelson Nash presented it to the globe.

How flexible is Financial Independence Through Infinite Banking compared to traditional banking?

Within these plans, the cash worth grows based upon a price established by the insurer. As soon as a significant money value builds up, insurance policy holders can acquire a money worth car loan. These car loans vary from conventional ones, with life insurance acting as security, suggesting one might lose their coverage if loaning exceedingly without adequate cash money value to support the insurance policy expenses.

And while the allure of these plans appears, there are innate constraints and threats, demanding diligent cash worth monitoring. The method's legitimacy isn't black and white. For high-net-worth individuals or organization proprietors, particularly those utilizing strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and compound growth could be appealing.

The appeal of limitless financial doesn't negate its obstacles: Expense: The foundational requirement, an irreversible life insurance plan, is pricier than its term equivalents. Eligibility: Not every person gets approved for whole life insurance policy because of strenuous underwriting processes that can leave out those with particular health or lifestyle problems. Complexity and danger: The complex nature of IBC, paired with its dangers, may discourage many, particularly when easier and much less high-risk options are readily available.

How does Financial Independence Through Infinite Banking create financial independence?

Alloting around 10% of your monthly earnings to the policy is just not viable for the majority of people. Utilizing life insurance policy as an investment and liquidity resource needs technique and surveillance of plan cash worth. Seek advice from a monetary expert to determine if boundless financial lines up with your concerns. Part of what you check out below is just a reiteration of what has already been stated above.

So before you obtain right into a scenario you're not gotten ready for, know the complying with first: Although the idea is typically sold therefore, you're not in fact taking a car loan from yourself. If that were the case, you wouldn't have to repay it. Instead, you're obtaining from the insurance coverage firm and need to repay it with interest.

Some social networks messages advise making use of money worth from whole life insurance policy to pay for charge card financial obligation. The concept is that when you pay back the car loan with rate of interest, the quantity will certainly be sent back to your financial investments. That's not exactly how it functions. When you repay the loan, a portion of that passion mosts likely to the insurer.

What are the common mistakes people make with Infinite Wealth Strategy?

For the first a number of years, you'll be paying off the commission. This makes it incredibly hard for your plan to collect value during this time around. Whole life insurance expenses 5 to 15 times extra than term insurance. Most individuals simply can't manage it. So, unless you can manage to pay a few to a number of hundred bucks for the next decade or more, IBC won't work for you.

By utilizing a whole life policy, families can ensure long-term financial stability.

Parents can use Infinite Banking to pay for major family expenses, all while retaining ownership of their capital.

Insurance brokers assist in ensuring maximum benefits for family security - infinite banking and real estate investing. Speak with a family wealth expert to pass down wealth effectively

If you need life insurance coverage, here are some important suggestions to consider: Take into consideration term life insurance policy. Make sure to shop around for the finest price.

Infinite Banking Retirement Strategy

Imagine never ever needing to stress over financial institution lendings or high passion rates once again. What if you could obtain cash on your terms and build wealth concurrently? That's the power of infinite financial life insurance policy. By leveraging the money value of whole life insurance policy IUL policies, you can expand your wealth and obtain cash without counting on traditional banks.

There's no collection financing term, and you have the freedom to select the repayment schedule, which can be as leisurely as settling the finance at the time of fatality. This flexibility expands to the servicing of the car loans, where you can go with interest-only repayments, keeping the lending equilibrium level and manageable.

Can I use Infinite Banking Benefits to fund large purchases?

Holding cash in an IUL repaired account being attributed interest can usually be better than holding the cash on down payment at a bank.: You have actually always desired for opening your own pastry shop. You can borrow from your IUL policy to cover the initial expenses of renting a room, buying equipment, and working with staff.

Individual finances can be acquired from conventional financial institutions and lending institution. Right here are some bottom lines to think about. Bank card can offer a versatile means to borrow cash for extremely short-term periods. Obtaining money on a credit score card is generally extremely pricey with yearly percentage rates of interest (APR) frequently reaching 20% to 30% or more a year.

Latest Posts

Infinite Banking Concept Book

Non Direct Recognition Whole Life Insurance

Becoming Your Own Banker Explained - Round Table